Welcome to this week's edition of Culture Correlations, where we dive into strategies and insights...

Navigating Turbulence: Boeing's Cultural Shift and Its Ripple Effects

Boeing is in the news again this week, and it doesn’t sound good. In one compelling examination, John Oliver ran a segment on Boeing that offers a deep and hilarious take on this story of corporate culture, safety, and the consequences of prioritizing profit over people.

An Altered Direction For Boeing

To catch us up, in the 1990s, Boeing, a titan in aircraft manufacturing, merged with McDonnell Douglas, eyeing an unassailable dominance in the aerospace industry. This strategic maneuver, aimed at consolidating resources and amplifying market presence, inadvertently steered Boeing into a storm that would challenge its storied legacy of quality, safety, and innovation.

Root Cause Analysis - Profit Over Quality:

Boeing once hailed for its unmatched quality and innovation in the aerospace sector, faced a turbulent period marked by the tragic incidents involving the 737 Max. Oliver’s segment outlines a series of decisions that, over time, significantly impacted Boeing's reputation and, more importantly, human lives. At the heart of Boeing's ensuing quagmire seems to be a profound realignment of priorities—shifting from an unwavering commitment to excellence towards a relentless pursuit of profit at any cost.

Is This a Common Trend in Mergers and Acquisitions?

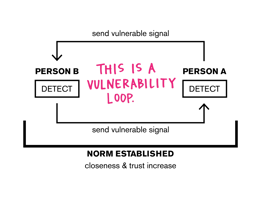

Unfortunately, yes. Many mergers and acquisitions focus on immediate financial gains rather than integrating and preserving the unique cultures and values of the involved companies. This can lead to a clash of priorities, where short-term financial goals overshadow the long-term vision and operational integrity of the company.

Instill's Perspective: Cultivating Resilience and Integrity

As leaders and organizations navigate the complexities of mergers, acquisitions, and cultural integration, Boeing’s narrative serves as a compelling case study, offering invaluable lessons. At Instill, we believe in the transformative power of a healthy, resilient culture—one that prioritizes integrity, safety, and excellence above all. For if we focus on these foundations, profits are sure to follow.

5 Ways to Avoid What Happened to Boeing in Your Next M&A Event:

- Conduct Cultural Due Diligence: Thoroughly assess the compatibility of both entities’ cultures. Identify disparities and strategize on harmonious integration.

- Ensure Transparent Communication: Maintain openness with all stakeholders. Transparency fosters trust and mitigates the uncertainties that accompany change.

- Reinforce Core Values and Mission: In times of transition, reiterate your unwavering commitment to the principles that define your legacy. Let these values guide decision-making processes.

- Establish Leadership Accountability: Cultivate a leadership ethos rooted in ethical conduct and long-term vision. Robust governance and oversight are crucial.

- Invest in Employee Training: Empower your workforce through comprehensive training programs. Encourage participation in shaping the post-merger culture.

Questions Leaders Should Ask During Transition

Here are some of the questions we wish the leadership had asked over at Boeing and you can ask before your next M&A:

- How does this change align with our core values?

- Have we adequately communicated the 'why' behind this transition to all stakeholders?

- Are we compromising on safety, quality, or our people for the sake of efficiency or cost savings?

- What mechanisms are in place to listen to and address employee concerns during this transition?

- What part of our culture do we stand to lose from this transition? How can we mitigate this?

Instill: Your Partner in Cultivating a Resilient Culture

As we reflect on Boeing’s story, it’s clear that nurturing a culture that balances innovation with integrity is crucial. At Instill, we understand the complexities of maintaining a healthy culture through transitions. Our Culture Operating System™ is designed to help leaders measure and enhance the vital signs of their organization's culture, ensuring that resilience, safety, and integrity remain at the forefront. During a transition, our AI-powered platform can offer you real-time flags around trust, job satisfaction, and psychological safety to help you address any deflation in culture quickly. M&A can be great for business and bring incredible value and profit to a company, but it doesn’t have to happen at the expense of culture.

Blog comments